Berkshire Hathaway Is Great. Here's Why You Shouldn't Buy It.

Berkshire Hathaway (NYSE: BRK.B) (NYSE: BRK.A) is not just an investment icon, it's also something of a cultural phenomenon. The company's annual meeting draws thousands of people to Omaha just to hear CEO Warren Buffett speak. This year was notably different than past years, however, and that might be enough to keep some investors on the sidelines.

What is Berkshire Hathaway?

While Berkshire Hathaway is a company with publicly traded stock, it is actually kind of hard to pin down what it does. It has a large insurance business, notably including the GEICO brand. But it also owns a railroad, a number of different utility operations, and pipelines that all get broken out into a separate operating group in the company's financials. But lumped in with Berkshire's insurance operations are "other" investments, which include clothing makers, a paint manufacturer, specialty parts companies, and retailers, among a long and broad list of business categories.

And then there's the nearly $336 billion worth of "investments in equity securities" that shows up on the company's balance sheet. Basically, the insurance business uses the premiums it collects (the float) to invest in stocks. While it may eventually have to pay out money to cover claims, it has used the float to build up a huge investment portfolio. In many ways, Berkshire Hathaway is more like a mutual fund than a traditional company.

That's largely because of Warren Buffett's influence on the company. Regardless of whether or not Berkshire Hathaway owns a business or just owns shares of the business, it lets the CEOs of the entity do their job. Buffett just keeps tabs on performance to ensure the CEO is doing a good job. Only if there are problems does he typically get involved. Meanwhile, a company (or investment) generally only gets into the portfolio if Buffett thinks it is attractively valued.

Simply put, Berkshire Hathaway is all about Warren Buffett. But for years, Buffett's partner was Charlie Munger. The two worked together to build the business into what it has become. Munger passed away in late 2023.

What happens after Warren Buffett?

Although Munger was older than Buffett, Buffett is not a young man. Questions about succession have been around for years, but now have taken on much greater prominence. All that Berkshire has really said on the matter is that it has a plan and it's going according to, well, plan. Buffett is known to be secretive about his plans, but this one could be very important for investors considering buying Berkshire stock.

Here's where things get interesting. Buffett prefers to hold cash if he can't find anything worth buying. The company ended the first quarter with around $182 billion in cash on its balance sheet. That's larger than the market cap of most public companies. At the time of this writing, that would be enough money to buy General Electric and just a little shy of the market cap of McDonald's. It's a huge sum of money.

Buffett has proven that he has the discipline to only put cash to work when he believes he can create value. But will the CEO that succeeds him have that same discipline? It is highly likely that Buffett will have had a hand in training his successor, but there's no way to know in advance what the next CEO's investment approach will be. Using that $182 billion unwisely could do a great deal of damage to shareholders and to Wall Street's perception of Berkshire Hathaway's stock.

To sum it up, given that Berkshire Hathaway is kind of like a giant mutual fund, the entire story here could change with a new manager at the helm. Meanwhile, the mutual-fund-like nature of the stock suggests that there's probably no particular rush to buy. Indeed, given the company's size, it's unlikely that a strong performance from one business line is going to have an outsize effect on the overall business anyway.

You wouldn't be wrong to buy it, but there's no rush

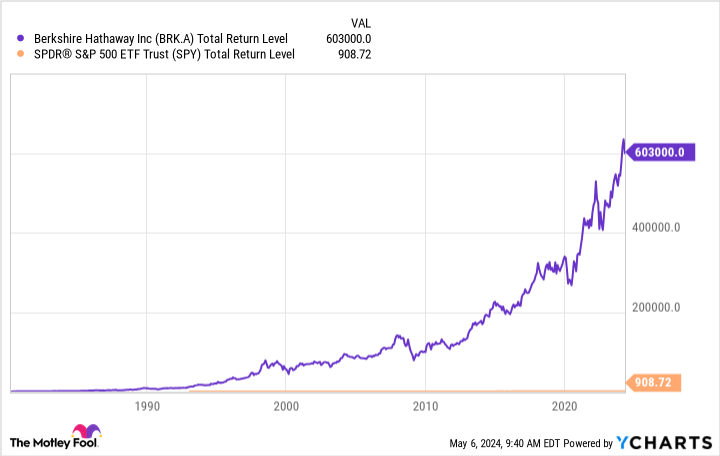

To be fair, there's no particular reason to believe that Buffett is going to step down tomorrow. And if you wanted to buy Berkshire Hathaway you probably wouldn't be making a mistake given its very impressive long-term success. However, there is a big change coming sooner rather than later. For more conservative investors, it might make sense to wait for the change at the top to take place so that the impact can be better assessed. If you do decide to buy shares, meanwhile, make sure you pay close attention to the CEO position.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $543,758!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 6, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.

Berkshire Hathaway Is Great. Here's Why You Shouldn't Buy It. was originally published by The Motley Fool